Traditional 401k and Roth IRA combo

The age-old battle is what's better: "Roth" or "Traditional"? Honestly, as long as you are putting some money towards a tax-advantaged retirement account, you are winning. These types of battles always make me wary, more so for the people who aren't investing. If you are waiting to invest because you don't know the "most" optimized way, stop what you are doing and just go do one. You can always change your contributions later if you so choose.

Traditional 401K

Now that that qualifier is out of the way, which one do I like? Can I say both? When I first started investing, I did all Roth mostly because it made sense in my head to pay the taxes now and get growth tax-free. Roth is beautiful in that way. But the con is you pay more on taxes today. And even though I didn't have all the knowledge, I still think that was the best move then, especially since my tax bracket was so low.

Now that I make more income and have learned about the Roth Conversion Ladder, I love putting into a Traditional 401(k) at least for the tax benefit now and strategies to avoid paying taxes later. With the Roth Conversion Ladder, when you retire early or just plain retire, you can offset a lot of the taxes you would have otherwise paid. When your pay is lower for a year, this can be beneficial. And while taxes may go up when you get older holistically, they may not either. And even if they do, you are most likely going to be in a lower tax bracket. As of this writing the maximum contribution you can make to a 401k is $22,500 a year. I would advocate investing up to your company match, fully funding your Roth IRA, and then maxing out your 401k.

Roth IRA

For my non-work retirement account, I switch gears and pick Roth almost every time. I may change my mind if my income is extremely high and I can't contribute to a Roth. The Roth IRA is flexible and an essential part of any retirement strategy. If you retire early you can access the contributions if needed before the traditional retirement age OR if you have plenty of taxable investments this could be the last thing you touch because it grows tax-free. There are also "qualified" expenses you could use to access the growth before 59 1/2. It is just a flexible retirement account and I love the flexibility.

There is always nuance, and you should look at your situation. But I find this dynamic duo of a one-two punch extremely helpful.

The Beauty of the Roth Conversion Ladder

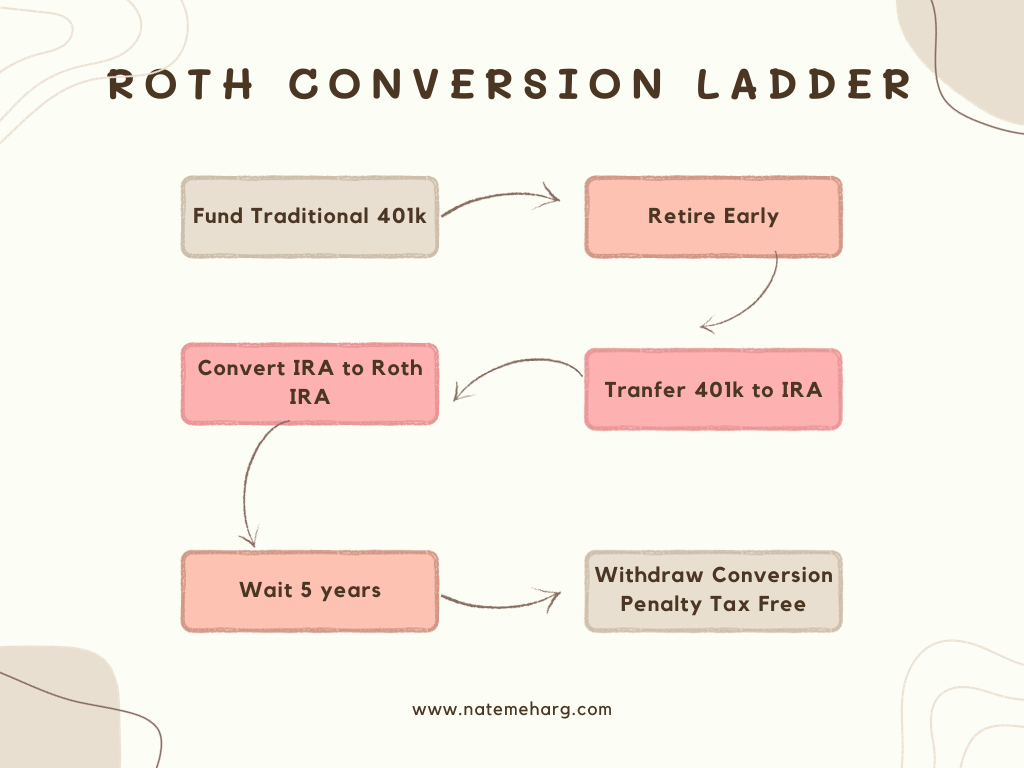

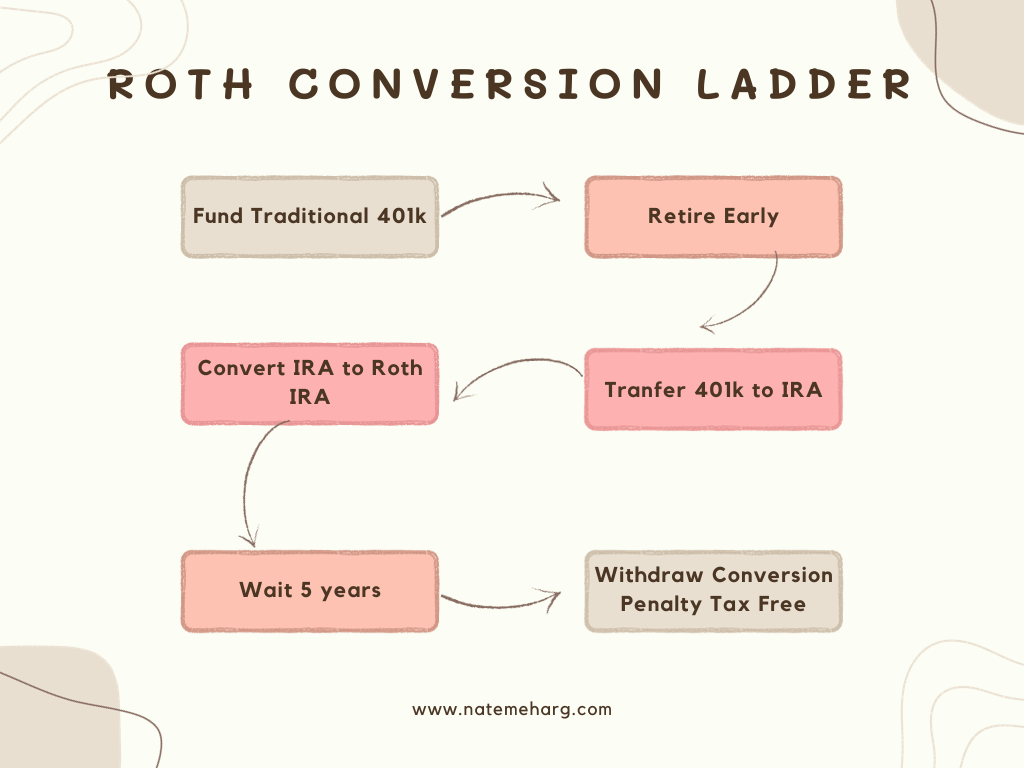

The Roth Conversion ladder is a strategy that allows you to access your retirement savings tax-free and penalty-free before reaching age 59½. It works by converting your traditional IRA or 401(k) money into a Roth IRA. When you convert, you have to pay income taxes on the amount you convert, but once the money is in your Roth IRA, it grows tax-free and you can withdraw it tax-free and penalty-free after five years.

To use a Roth Conversion ladder, you would start by converting a small amount of money from your traditional IRA or 401(k) into your Roth IRA each year. You would then wait five years before withdrawing any of the converted money. Once you've waited five years, you can withdraw the converted money tax-free and penalty-free.

The Roth Conversion ladder is a great strategy for early retirees because it allows them to access their retirement savings tax-free and penalty-free before they reach age 59½. It is also a good strategy for people who expect to be in a lower tax bracket in retirement than they are now.

Conclusion

In conclusion, as long as you invest in tax-advantaged retirement accounts you are doing good. I just like to control the controllable I know I will get tax savings now when I put money into a traditional 401k and love the ability to pull out my money from a Roth IRA early. And using the Roth conversion ladder I could pay little to no taxes later.

Disclaimers

As an Amazon Associate, I earn from qualifying purchases and other links, but not all.

This article is informational; it should not be considered Health, Financial, or Legal Advice. Not all information will be accurate. Consult health, financial, or legal professionals before making any significant decisions.

Follow me on LinkedIn!

Books, Credit Cards, Software, and Products I recommend

Updated 10/10/23