Investing Series Part 6 - How Do I Start Investing?

How to get started investing!

This is probably the biggest question I get. And my answer is simple. Just do it. Yes, of course, there are more optimized and straightforward ways to invest. Many blogs have been written about the best, simplest, and most straightforward investment method. And figuring out the best way to invest is a piece of the puzzle, but the centerpiece of investing is .... well, actually investing.

I work in product, and it is similar in this way. People don't "know" the "best" way to do something, so they get some education. Which is good, but then they are confused and still don't know, so they continue to get an education. Until 20 years go by, and they haven't done anything. If they had started after getting a little education, they would have learned along the way and learned a more optimized way to invest while they were investing and be better off in the long run.

Practical Tips

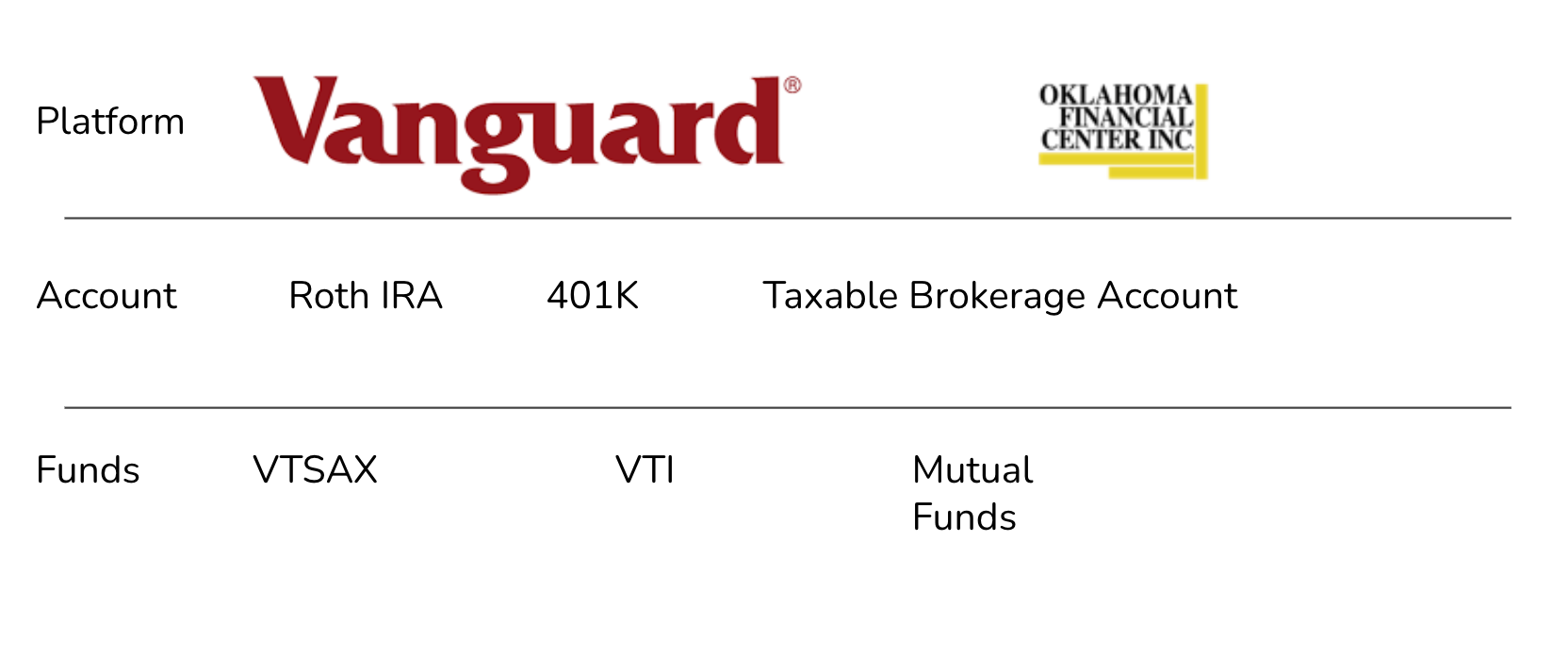

I always advocate investing in low-cost index funds. When investing in stocks, bonds, ETFs, mutual funds, and index funds, there are three things you need to keep in mind.

- The Type of Account

- The Brokerage

- The Fund

Type of Account

In the US and some other countries, there are different types of accounts you can put money into. These different types of accounts may have tax benefits, growth benefits, and rules on accessing the funds tied to them. In the United States, these are your 401ks, IRAs, Taxable Brokerage Accounts, 529 plans, etc.

The Brokerage

The brokerage is the company or exchange that buys your stocks, bonds, mutual funds, ETFs, and index funds for you. These are the Vanguards, Fidelity, Edward Jones, etc. Each one may have access to different account types and will have access to different funds. Different brokerages may have access to the same funds, but not all.

The Fund

Next would be the fund(s) you want to invest in. This could be a single stock, bond, mutual fund, ETF, etc. I prefer passively managed index funds or passively managed ETFs. ETFs and Index Funds are almost identical, except index funds are passively managed mutual funds, and ETFs are treated like stocks. The difference is slight, but essentially, mutual funds can only be bought and sold once or twice a day, whereas ETFs can be traded like a stock during trading periods. That is essentially the difference. I prefer index funds from a behavioral standpoint since I'm not a day trader, but that's "picking nits," as they say. The type of funds I like are the following: S&P 500 Funds, Total US Stock Market Funds, Total World Stock Market Funds, or Target Date Funds. I prefer Vanguard's version of these funds, but as stated before, especially with your employer's retirement plan, you may not have many choices. The expense ratio also has to be under .20% as a rule. Most of these funds will be below .10% as of this writing.

My Preferred Steps of Investing

- Employer Company Match - this is money you leave on the table if you don't take advantage of it.

- Emergency Fund and Savings - Save for everyday things like car maintenance and have enough cash to cover at least next month's expenses if you didn't cut back.

- Pay off High-Interest Debt - any debt above 5% pays it off. Period.

- Max out Retirement Accounts - In the US. You can max out your work contribution plan (401k) and IRA.

- Pay off Low-Interest Debt OR Invest in a Taxable Brokerage Account - I prefer paying off low-interest debt due to the risk.

Disclaimers

As an Amazon Associate, I earn from qualifying purchases and other links, but not all.

This article is informational; it should not be considered Health, Financial, or Legal Advice. Not all information will be accurate. Consult health, financial, or legal professionals before making any significant decisions.

Books, Credit Cards, Software, and Products I recommend

Follow me on LinkedIn.

If you want to ask me a question or reach out to me. You can contact me here.

Updated 10/31/23